Tax Codes & Tax Rates

Confused about Tax Codes and Tax Rates? Not sure which one to use? That's ok, we get it. Taxes are often a complicated topic. We are not tax advisers, so if you are not sure about what or how much to charge, we encourage you to contact a tax expert.

We can show you where to enter the taxes you have to collect in our software, but we can't advise you on what gets taxed, how much, or even which tax to charge, consult your Accountant or other tax professional.

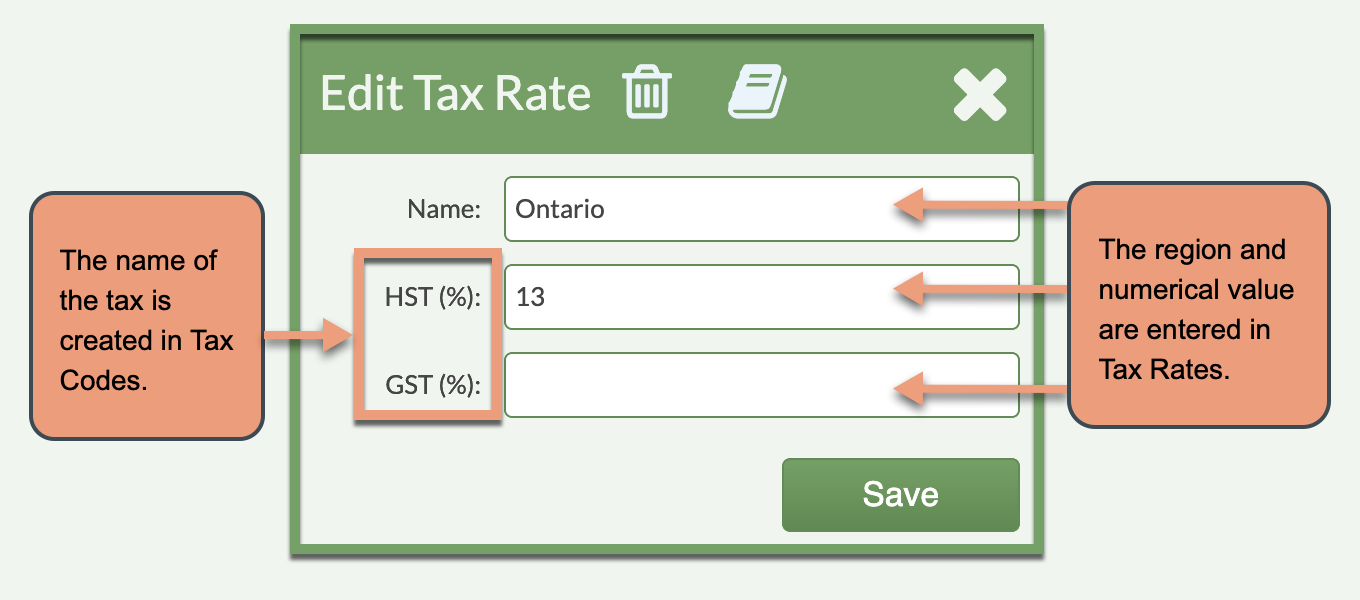

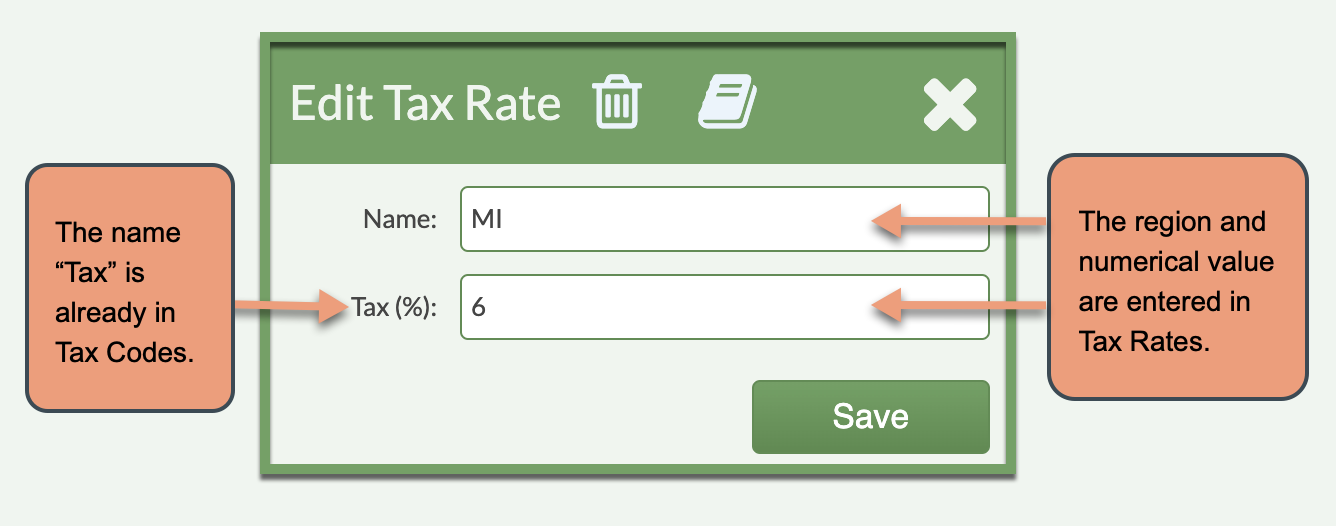

When setting up CounterGo, you can think of taxes in two parts, naming the tax you collect and entering how much that tax is in the areas where you do business.

- Tax Codes are where you name the tax you have to collect.

- Tax Rates are where you enter a particular county, city, state, province, or region and a numeric value for how much that tax is.

If you live in the US, you probably won't need to adjust your Tax Code, your database came with one called "Tax" built in.

If you live outside the US and have to collect HST, GST, VAT, etc., you enter those in Tax Codes.

Regardless of where you live and how many Tax Codes you have, you will need to create and enter the numerical values for each area you collect taxes in by going to Settings > Quote & Order > Tax Rates. Once entered you can assign default rates to Price Lists or Accounts, or manually make selections in Step 6.