Custom Tax Rates For QuickBooks Online

Do you export CounterGo Orders to QuickBooks Online and need to match up sales tax? Whether you use only one QuickBooks tax rate or have combined tax rates for state, county, and/or city tax rates, enter custom tax rates into CounterGo as a Tax Rate.

There are steps that need to happen in both QuickBooks and CounterGo. Set up Custom Tax Rates in QuickBooks first, then enter the rate, or combined rate, as a single Tax Rate in CounterGo.

The name of the Custom Tax Rate in QuickBooks and the Tax Rate in CounterGo must match exactly.

CounterGo Tax Rates can be applied to Accounts or Price Lists.

QUICKBOOKS

- Run the auto-setup for taxes in QuickBooks to turn on Automatic Sales Tax.

- Go to Taxes > Sales Tax Settings.

- Under Custom Rates, click the Add Rate button.

COUNTERGO

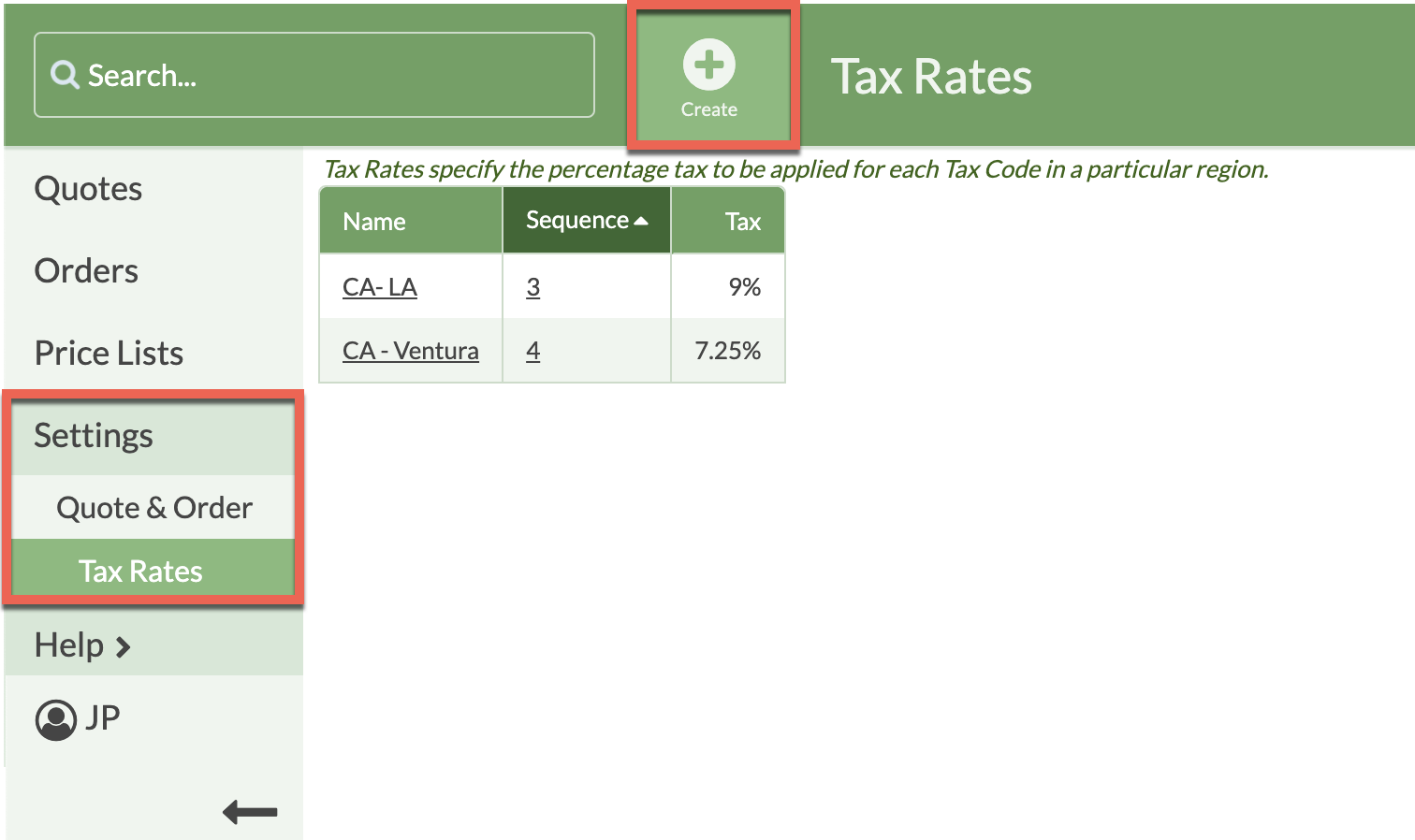

- Go to Settings > Quote & Order > Tax Rates.

- Click the Create button and name the Tax Rate the same as the Custom Sales Tax Rate in QuickBooks. Enter the total rate in CounterGo.

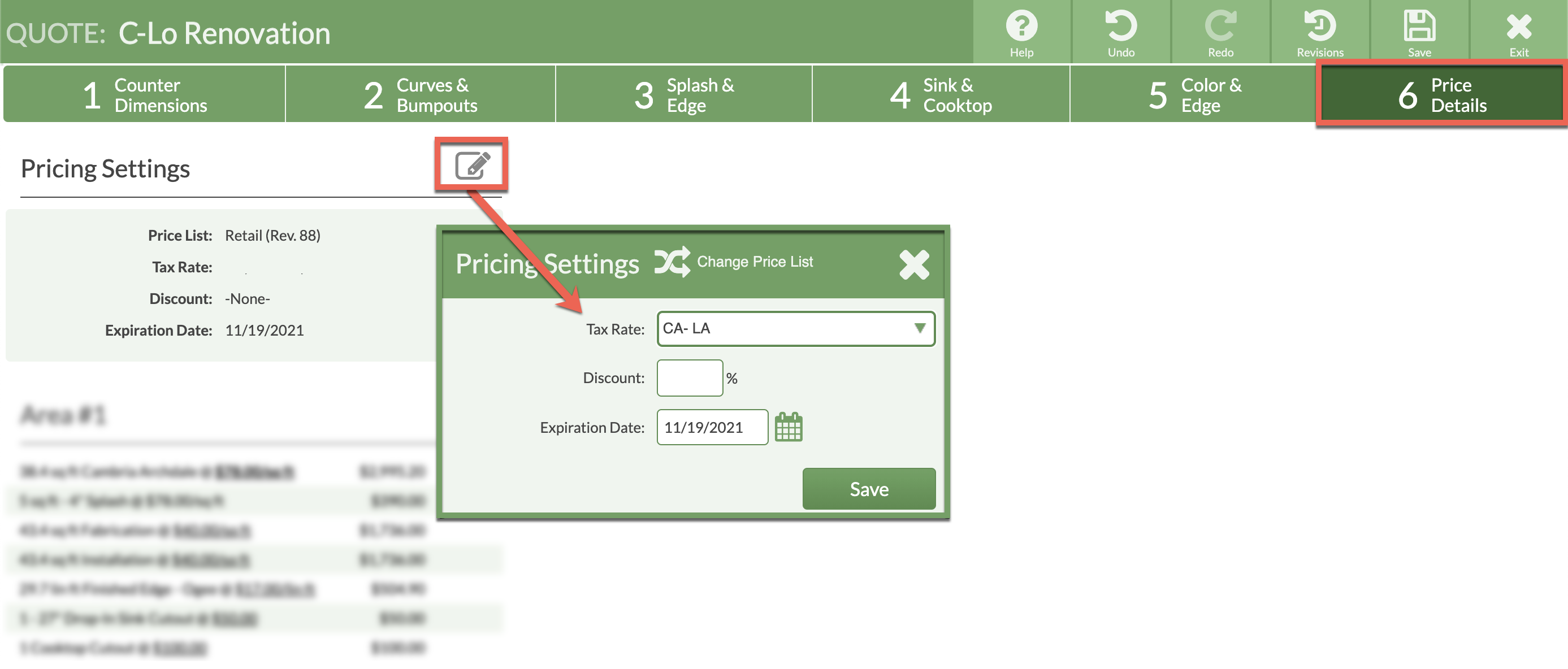

- To apply the Tax Rate to a Quote in Step 6, click the Price Settings Edit icon and select a Tax Rate.