Create Multiple Tax Codes (HST/GST/PST/VAT)

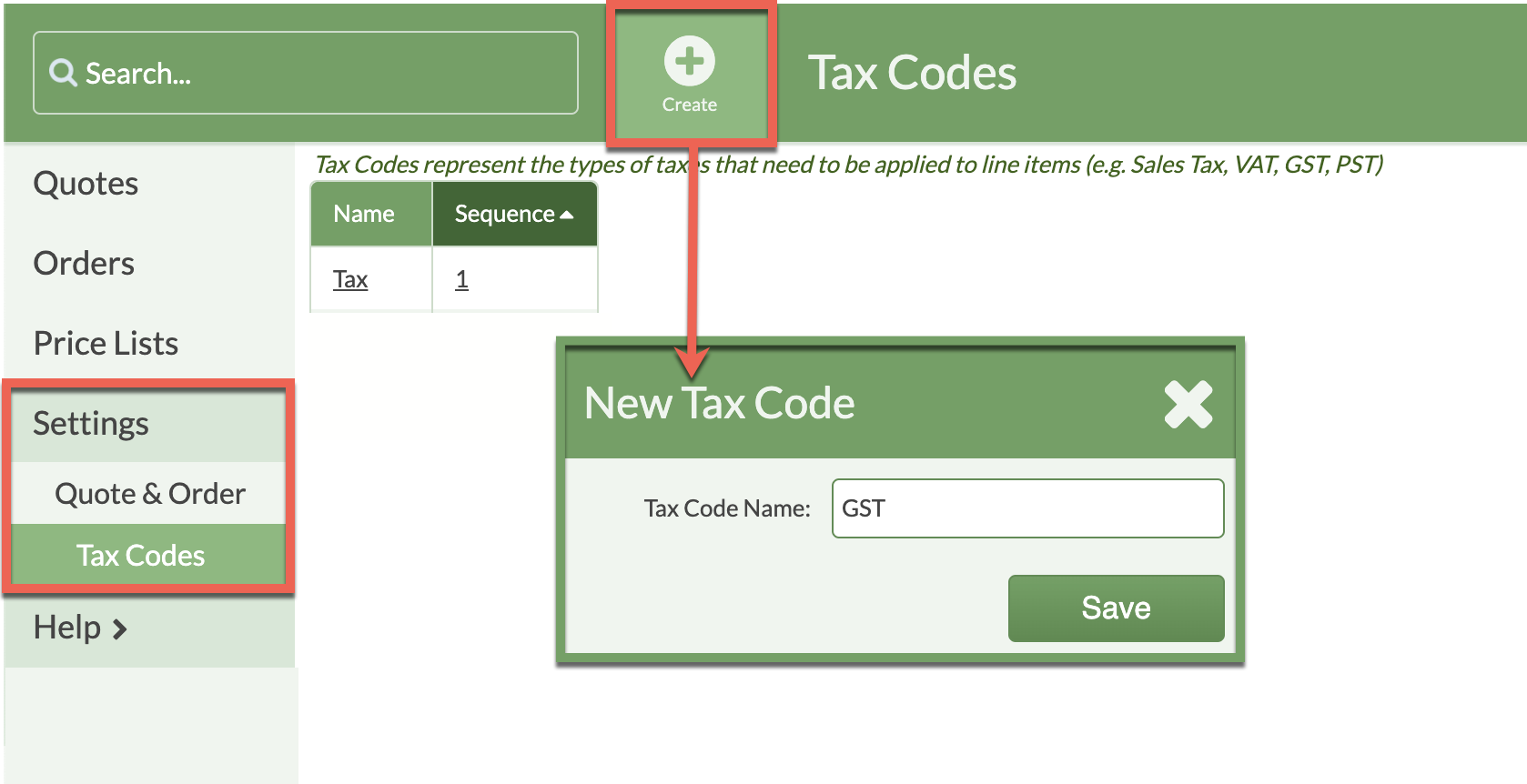

Some fabricators have to manage multiple Tax Codes - like HST, GST, PST, or VAT, where different items are taxed at different rates according to each code. Although CounterGo comes with the Tax Code called "Tax", If you live outside the US, you may need to add additional Tax Codes for HST, GST, PST or VAT.

Most users in the US do not need to make any changes to their Tax Code, they can proceed to enter their Tax Rates. If you live in a place where you do collect additional taxes, enter those names here, then you will enter the percentage in Tax Rates.

We can show you where to enter the taxes you have to collect in our software, but we can't advise you on what gets taxed, how much, or even which tax to charge, consult your Accountant or other tax professional.

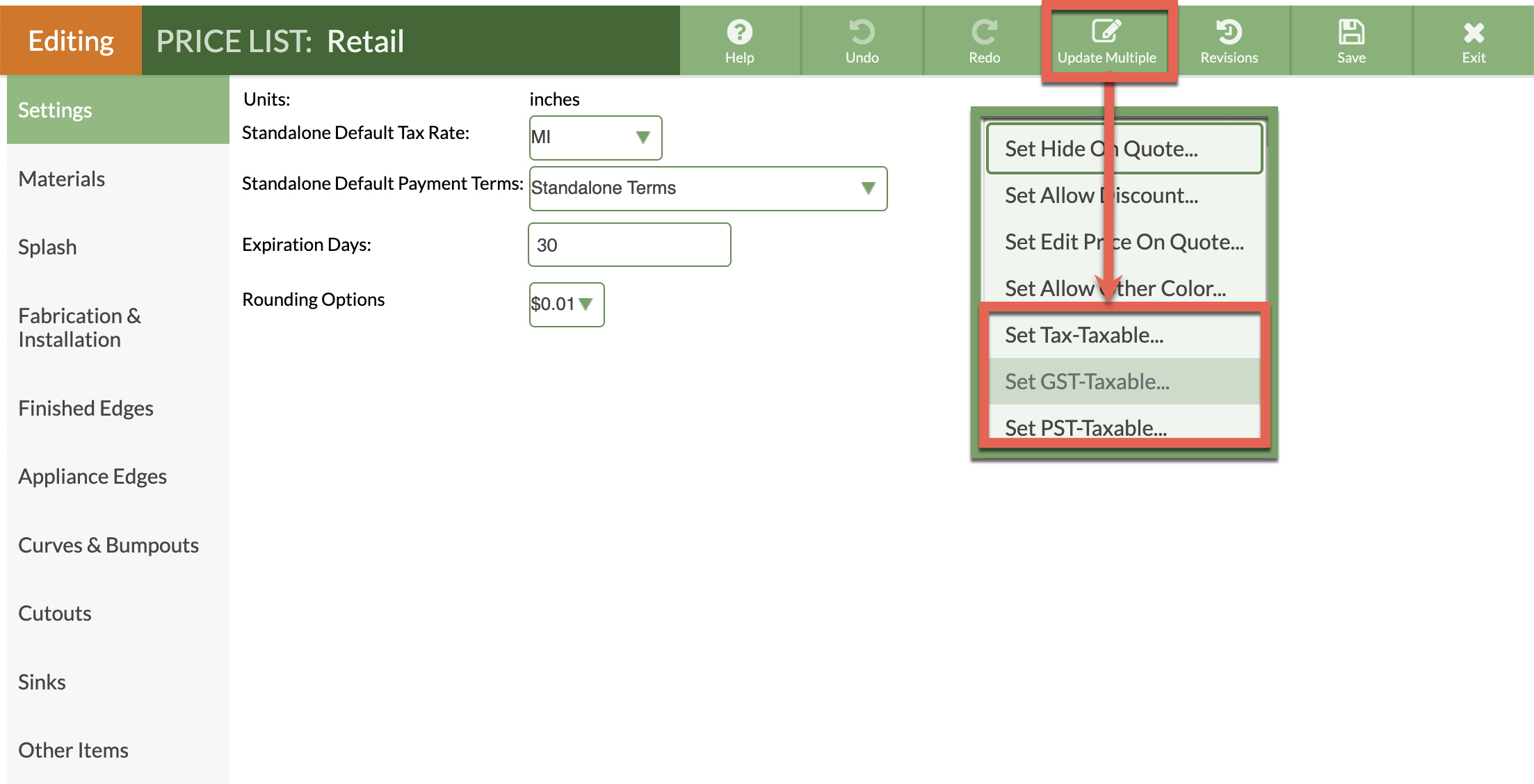

In your Price List you can set which items will be taxed for each Tax Code.

- Go to Settings > Quote & Order > Tax Codes.

- Click the +Create button.

- Enter the Tax Code Name and click Save.

- Click on Sequence Number to re-order the rates if necessary.

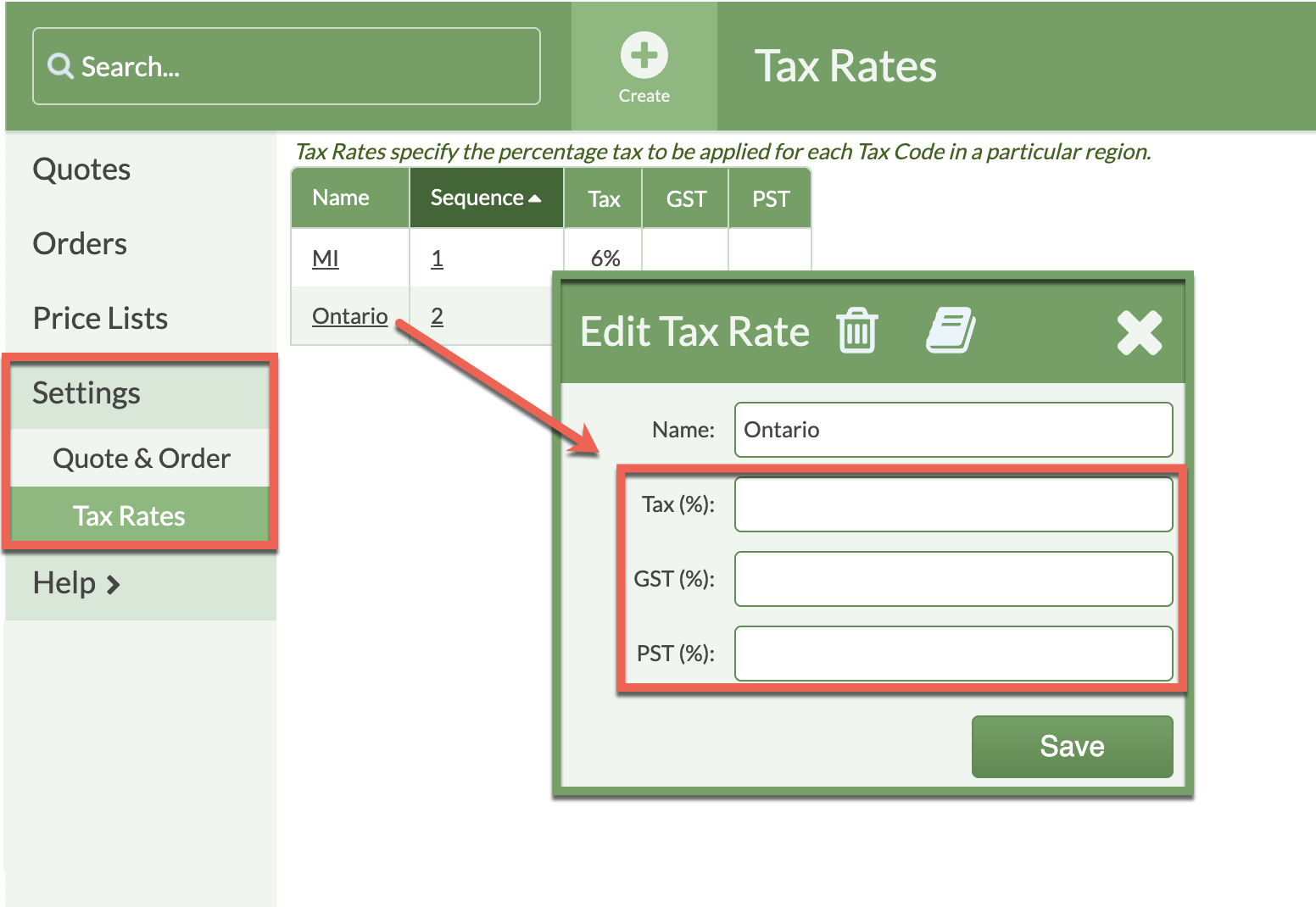

- Go to Settings > Quote & Order > Tax Rates > enter the appropriate percentages for your Tax Codes.

- Go to your Price List(s) and mark which items are taxable under each Tax Code using the Update Multiple button.