QuickBooks Integration Overview

Curious about CounterGo's QuickBooks Integration? CounterGo Orders and Payment information can be exported into QuickBooks. This communication is one way, meaning information is sent from CounterGo to QuickBooks, nothing is sent from QuickBooks back to CounterGo.

You have full control of which Orders get exported and when, Orders are not automatically exported. Once CounterGo Orders are exported to either QuickBooks Invoices or Estimates, or if Payments are tracked in CounterGo, they can be updated if the Order changes. You can customize your CounterGo Views to keep track of what has and has not been exported, or what may need updating.

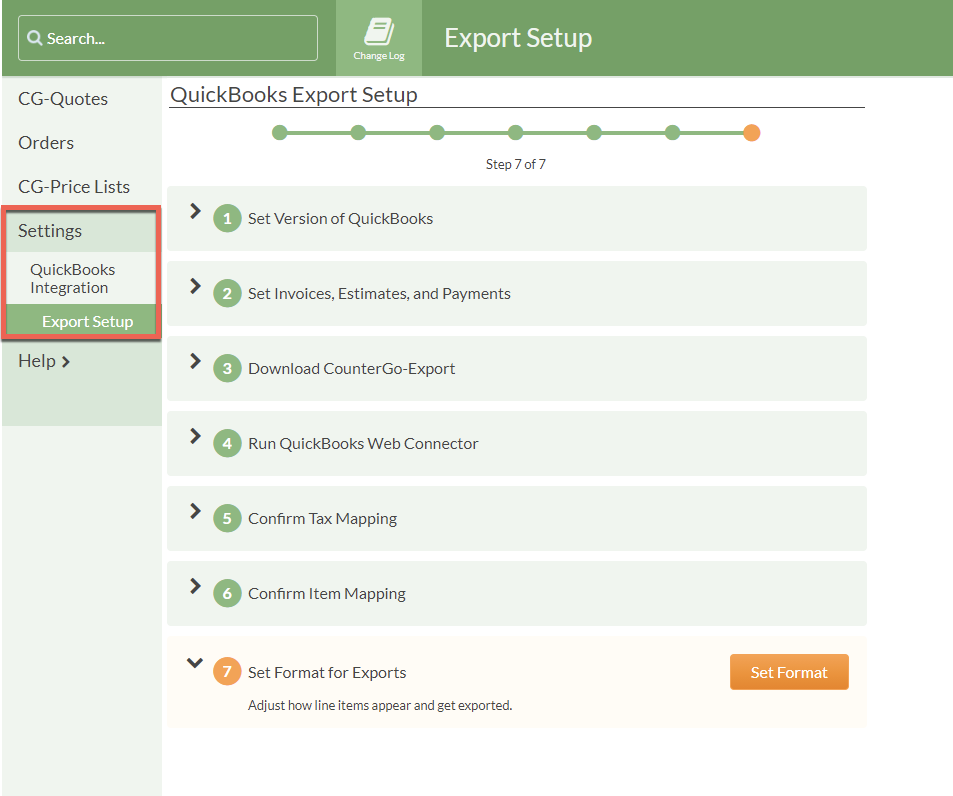

CounterGo will walk you through each step to integrate with QuickBooks. Some basics are outlined below, If you'd like to talk details, email support@moraware.com.

If you are not a CounterGo user yet, visit moraware.com/pricing to schedule a demo.

CounterGo Orders: Only Orders, not Quotes, can be exported to QuickBooks. If you have not already started using Orders, add it to your workflow before integrating with QuickBooks.

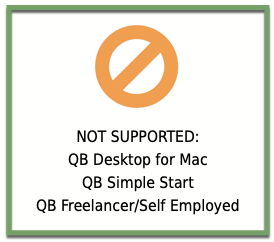

QuickBooks Online or QuickBooks Desktop: You can use either version of QuickBooks with CounterGo if you use a PC. Because CounterGo is web-based, if you use QuickBooks Desktop you'll need to also use the Web Connector that QuickBooks developed. The QuickBooks Web Connector does not support QuickBooks Desktop for Mac, so Mac users can use the Online version only for CounterGo integration. QuickBooks Online Simple Start and Freelancer/Self Employed are not compatible with the QuickBooks Integration.

Custom Transaction Numbers: Custom Transaction Numbers in QuickBooks Online will need to be disabled to use CounterGo's QuickBooks Integration.

QuickBooks Invoice or Estimate: CounterGo Orders can be exported to either QuickBooks Invoices or Estimates. Payments can not be attached to Estimates, CounterGo Payments can only be exported to Invoices. If you set up to export to Estimates and want to change and export Invoices, or vice versa, the settings can be edited.

Payments: If you track Payments in CounterGo, those can be exported to QuickBooks Invoices, and updated if additional CounterGo Payments are recorded after the initial export. Exports are one way communication, if you record transactions in QuickBooks, they will not be reflected in CounterGo. It's best to track payments in CounterGo or QuickBooks, but not both.

Tax: Before you begin, be sure you have set up your Tax Rates and Tax Codes in CounterGo the same as in QuickBooks. You will be prompted to map your CounterGo Tax to QuickBooks. We can show you where to enter the taxes you have to collect in our software, but we can't advise you on what gets taxed, how much, or even which tax to charge. Consult your Accountant or other tax professional.

Item Mapping: Mapping items to QuickBooks will not have the same level of detail as your CounterGo Price List. Be sure you have your products and services defined in QuickBooks before you begin mapping in CounterGo. We recommend mapping your Price List items into general categories, like Material, Labor, Sales, etc.

Views: After integrating QuickBooks, add the QuickBooks Export field to any View for a quick way to track if an Order has been exported to QuickBooks and the current status.